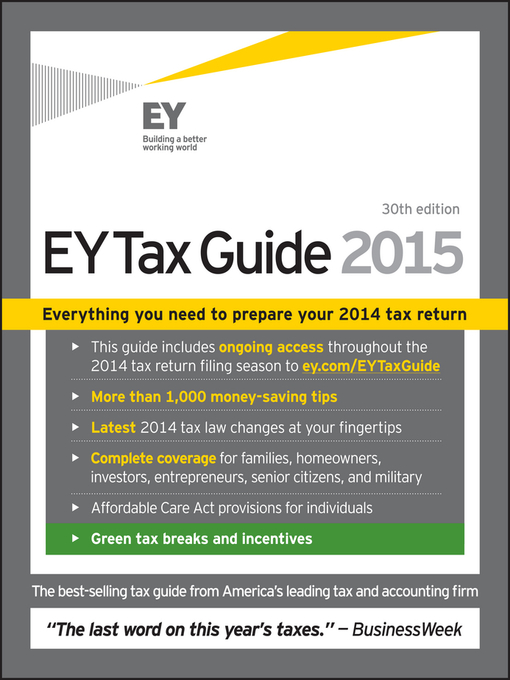

EY Tax Guide 2015 is your solution for a streamlined filing process. Authoritative and easy to follow, this trusted guide is designed to be accessible for individuals who need help navigating these turbulent financial times, providing information that can maximize deductions and avoid mistakes.

Reference tables allow for quick look-up of useful information, including changes to tax law, common errors, and tax breaks, while the Special Content index points you toward answers for homeowners, senior citizens, investors, military personnel, entrepreneurs, and more. Fully updated for 2015, this guide even provides up-to-date tips on environmental credits for green initiatives.

As global leader in tax and advisory services, it's no surprise that this EY (formerly Ernst & Young) guide has been rated the #1 choice in tax prep by USA Today. Distilling complex tax information into straightforward language, this resource is essential reading for anyone preparing to file a federal income tax return. You'll find hundreds of examples illustrating how tax laws work, plus sample forms and schedules that help you fill out your return step by step. We can help you save time and money as you:

Preparing your own taxes doesn't have to mean wading through tax code or missing deductions. This guide contains the insight of EY professionals, plus the tools and references that can help ease the process. The EY Tax Guide 2015 provides the information you need to file your taxes yourself, with confidence.

The EPUB format of this title may not be compatible for use on all handheld devices.